The automotive industry witnessed a surprising development during 2022 that challenged traditional market hierarchies. Established brand loyalties faced unprecedented disruption from an unexpected competitor.

MG Motor‘s remarkable ascent represents one of the most significant market share shifts in recent automotive history. The brand’s strategic approach has fundamentally altered competitive dynamics across multiple market segments.

Historical Context and Background

MG’s Heritage Revival

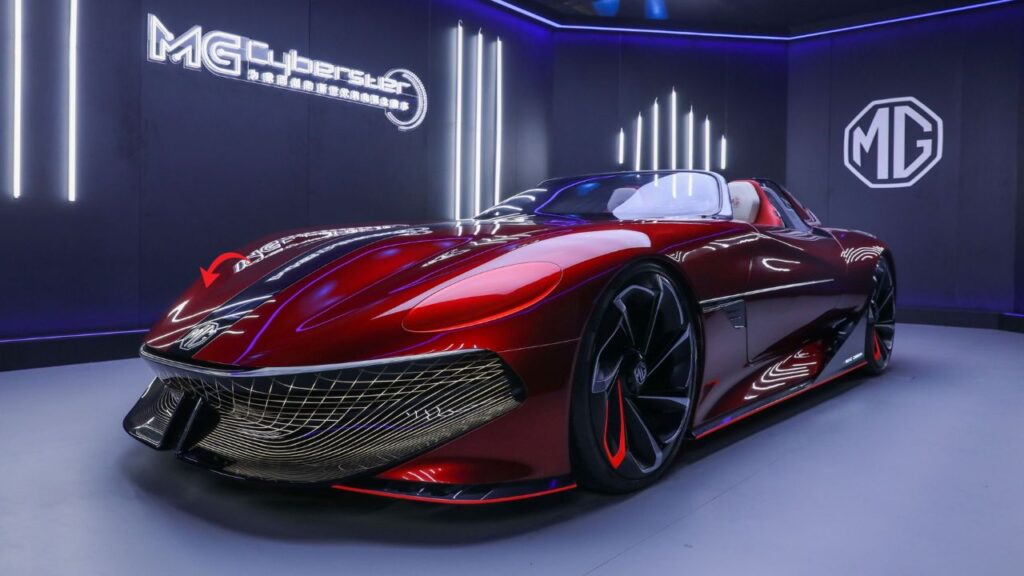

The MG brand carries decades of automotive heritage dating back to British sports car manufacturing. However, the modern iteration under SAIC Motor ownership represents a completely different strategic approach.

Chinese investment has transformed MG from a niche sports car manufacturer into a mainstream volume brand. This transformation enabled competitive pricing while maintaining acceptable quality standards.

Market Entry Strategy

MG’s Australian market re-entry began cautiously with limited model offerings and dealer networks. The brand focused on establishing credibility before expanding into competitive mainstream segments.

Initial success with budget-conscious consumers provided the foundation for broader market expansion. Early adopters became brand ambassadors, helping overcome skepticism about Chinese automotive quality.

2022 Performance Analysis

Sales Volume Achievements

MG’s 2022 sales figures exceeded industry expectations by substantial margins. Monthly registration data showed consistent growth throughout the year across multiple vehicle categories.

The brand’s market share percentage climbed steadily, eventually surpassing both Volkswagen and Nissan in several key metrics. This achievement represented a seismic shift in Australian automotive preferences.

Model Portfolio Success

The MG ZS compact SUV became a standout performer in the competitive small SUV segment. Its combination of features, warranty coverage, and pricing attracted first-time SUV buyers.

Electric vehicle offerings like the MG ZS EV captured significant market attention. Early electric vehicle adoption provided MG with additional competitive advantages.

Strategic Advantages Analysis

Pricing Strategy Excellence

MG’s aggressive pricing approach disrupted traditional automotive pricing structures significantly. The brand offered features typically reserved for premium segments at mainstream prices.

Value proposition clarity helped consumers understand the benefits of choosing MG over established alternatives. Transparent pricing without hidden fees or complicated option packages appealed to budget-conscious buyers.

Warranty and Service Innovation

Seven-year warranty coverage provided unprecedented peace of mind for Australian consumers. This commitment demonstrated confidence in product quality while addressing reliability concerns.

Roadside assistance inclusion and comprehensive coverage terms exceeded industry standards significantly. These service innovations helped overcome traditional brand loyalty barriers.

Competitive Response Evaluation

Volkswagen’s Market Position

Volkswagen’s premium positioning strategy faced challenges from MG’s value-focused approach. Traditional German engineering advantages became less compelling when price differences were substantial.

The brand’s complex model lineup and options structure contrasted unfavorably with MG’s simplified approach. Consumer confusion about pricing and features contributed to market share erosion.

Nissan’s Strategic Challenges

Nissan’s aging product lineup struggled to compete with MG’s newer technologies and features. The brand’s reputation for reliability couldn’t overcome significant price disadvantages.

Limited electric vehicle offerings left Nissan vulnerable to MG’s growing EV portfolio. Market trends toward electrification favored brands with comprehensive electric strategies.

Consumer Behavior Shifts

Brand Loyalty Evolution

Traditional automotive brand loyalty showed signs of weakening among Australian consumers. Economic pressures made value proposition considerations more important than heritage or prestige.

Younger buyers demonstrated greater willingness to consider alternative brands if value propositions were compelling. This generational shift benefited newcomers like MG significantly.

Feature Prioritization Changes

Modern consumers prioritized technology integration and comprehensive warranty coverage over traditional automotive attributes. MG’s focus on these areas aligned perfectly with evolving preferences.

Safety ratings and fuel efficiency became more important than brand prestige for many buyers. MG’s competitive performance in these areas supported their market share growth.

Distribution Network Development

Dealer Expansion Strategy

MG’s dealer network growth followed a carefully planned expansion timeline. Strategic location selection ensured optimal coverage while maintaining service quality standards.

Dealer training programs emphasized customer service excellence to overcome potential brand perception challenges. Consistent service delivery across the network built consumer confidence.

Service Infrastructure Investment

Parts availability improvements reduced service wait times and enhanced customer satisfaction. Investment in local parts inventory demonstrated long-term market commitment.

Mobile service offerings and extended service hours provided convenience advantages over traditional competitors. These innovations appealed to time-constrained modern consumers.

Product Portfolio Strengths

SUV Segment Dominance

MG’s SUV offerings captured significant market share in the rapidly growing compact and mid-size segments. The ZS and HS models provided compelling alternatives to established competitors.

Feature-rich specifications at competitive price points attracted buyers from premium brands seeking better value. Technology integration matched or exceeded much more expensive alternatives.

Electric Vehicle Leadership

Early commitment to electric vehicle development positioned MG advantageously in the growing EV market. The ZS EV and other electric models offered practical range at accessible prices.

Government incentives for electric vehicles amplified MG’s cost advantages in this segment. Environmental consciousness among consumers supported electric model sales growth.

Quality Perception Transformation

Manufacturing Standards Improvement

Chinese automotive manufacturing quality has improved dramatically over the past decade. MG benefits from these broader industry improvements while maintaining cost advantages.

Independent quality assessments validated MG’s reliability claims, helping overcome consumer skepticism. Real-world ownership experiences supported positive word-of-mouth marketing.

Technology Integration Success

Advanced infotainment systems and driver assistance features demonstrated MG’s technological capabilities. These systems often exceeded those found in more expensive competitors.

Smartphone integration and connectivity features appealed particularly to younger demographics. Technology-forward brand positioning attracted consumers seeking modern automotive experiences.

Market Segmentation Impact

First-Time Buyer Attraction

MG’s pricing strategy made new car ownership accessible to previously excluded consumer segments. Young professionals and growing families found affordable access to modern automotive features.

Simple financing options and competitive interest rates further improved accessibility. These factors expanded the overall new car market while building MG’s customer base.

Fleet Market Penetration

Business fleet operators discovered significant cost savings through MG adoption. Comprehensive warranty coverage reduced total cost of ownership for commercial applications.

Government fleet trials provided credibility and visibility for the brand. Public sector adoption helped validate MG’s reliability for private consumers.

Regional Performance Variations

Urban Market Success

Metropolitan areas showed stronger MG adoption rates due to diverse demographics and increased price sensitivity. Urban consumers proved more willing to try alternative brands.

Dealer accessibility in major cities supported test driving and service convenience. Urban infrastructure better supported electric vehicle adoption where MG had strong offerings.

Rural Market Development

Regional areas showed more gradual MG adoption due to traditional brand loyalties and limited dealer presence. However, value propositions gradually overcame initial resistance.

Local dealer establishment in regional centers improved brand accessibility and service confidence. Agricultural and commercial applications found MG’s value proposition compelling.

Economic Context Influence

Inflation Impact Management

Rising living costs made MG’s value positioning increasingly attractive to cost-conscious consumers. Economic pressures accelerated the shift away from premium-priced alternatives.

Fuel efficiency advantages provided ongoing operational savings that compounded over time. These benefits became more important as fuel prices increased.

Supply Chain Resilience

MG’s supply chain management proved more resilient than some competitors during global disruptions. Shorter delivery times provided competitive advantages when other brands faced delays.

Local parts availability improvements reduced service disruptions and enhanced customer satisfaction. Supply chain reliability became a differentiating factor for consumers.

Marketing Strategy Effectiveness

Digital Marketing Innovation

MG’s social media presence and digital marketing campaigns reached younger demographics effectively. Modern marketing approaches aligned with the brand’s technology-forward positioning.

Influencer partnerships and online reviews generated authentic brand awareness among target audiences. Digital-first marketing strategies proved cost-effective compared to traditional automotive advertising.

Community Engagement Programs

Local community involvement and sponsorship activities built brand recognition and goodwill. These grassroots marketing efforts complemented broader advertising campaigns effectively.

Customer testimonial programs showcased real ownership experiences to potential buyers. Authentic customer stories proved more compelling than traditional automotive marketing messages.

Future Growth Trajectory

Model Expansion Plans

MG’s product development pipeline includes additional models targeting specific market segments. Continued portfolio expansion should support further market share growth.

Premium model introductions may attract conquest sales from luxury competitors. Upmarket expansion while maintaining value positioning presents both opportunities and challenges.

Technology Development Investment

Continued investment in electric vehicle technology and autonomous driving features positions MG for future market trends. Technology leadership could provide sustainable competitive advantages.

Connected vehicle services and over-the-air updates represent additional revenue opportunities. These capabilities may transform automotive business models significantly.

MG’s 2022 achievement in surpassing Volkswagen and Nissan market share represents a fundamental shift in automotive competition. Value-focused strategies proved more compelling than traditional brand prestige.

Consumer behavior changes favor brands that prioritize features, technology, and value over heritage and status. MG’s success demonstrates the effectiveness of customer-centric strategies.

The automotive industry must adapt to changing consumer expectations or risk market share erosion. Traditional brands can learn valuable lessons from MG’s strategic approach and execution.

Frequently Asked Questions

Q: How did MG manage to surpass established brands like Volkswagen and Nissan?

MG combined aggressive pricing, comprehensive warranties, modern technology, and strong value propositions to attract cost-conscious consumers seeking reliable transportation.

Q: What role did electric vehicles play in MG’s market share growth?

Electric vehicle offerings like the MG ZS EV provided early entry into the growing EV market with competitive pricing and practical range capabilities.

Q: Is MG’s success sustainable against traditional automotive competitors?

Continued investment in product development, technology advancement, and service network expansion suggests MG can maintain competitive advantages in the evolving market.